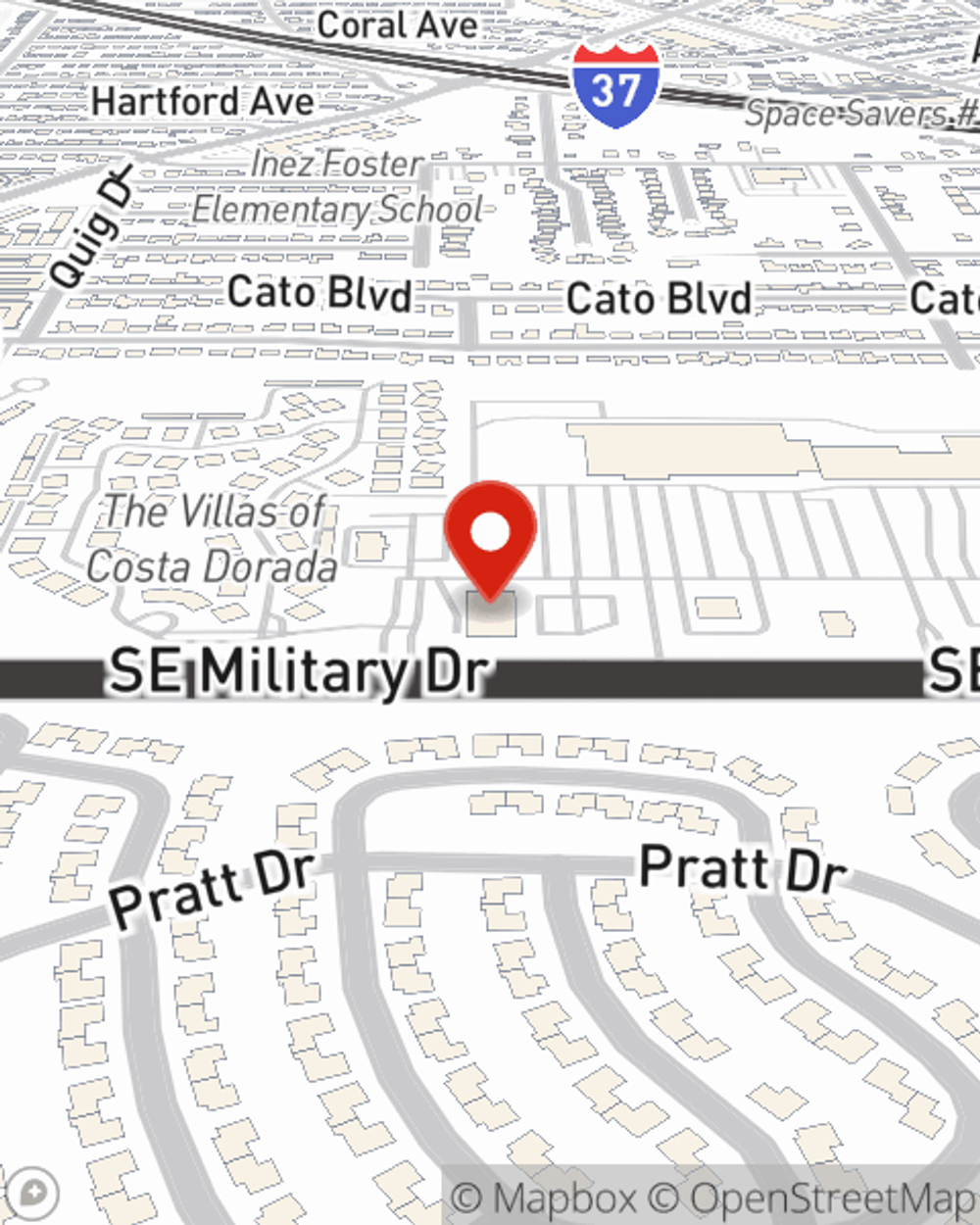

Business Insurance in and around San Antonio

Looking for small business insurance coverage?

No funny business here

- San Antonio

- Bexar County

- Floresville

- Brooks City Base

- Elmendorf

- China Grove

- Southtown

- Adkins

- Highlands

- South San Antonio

- Poteet

- Von Ormy

- Somerset

- St. Hedwig

Business Insurance At A Great Price!

Running a small business comes with a unique set of challenges. You shouldn't have to face those alone. Aside from just your family and friends, let State Farm be part of your line of support through insurance options including a surety or fidelity bond, extra liability coverage and business continuity plans, among others.

Looking for small business insurance coverage?

No funny business here

Keep Your Business Secure

When you've put so much personal interest in a small business like yours, whether it's a bakery, a dry cleaner, or an appliance store, having the right protection for you is important. As a business owner, as well, State Farm agent Sonia Flores understands and is happy to help with customizing your policy options to fit the needs of you and your business.

Call or email agent Sonia Flores to discuss your small business coverage options today.

Simple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Sonia Flores

State Farm® Insurance AgentSimple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.